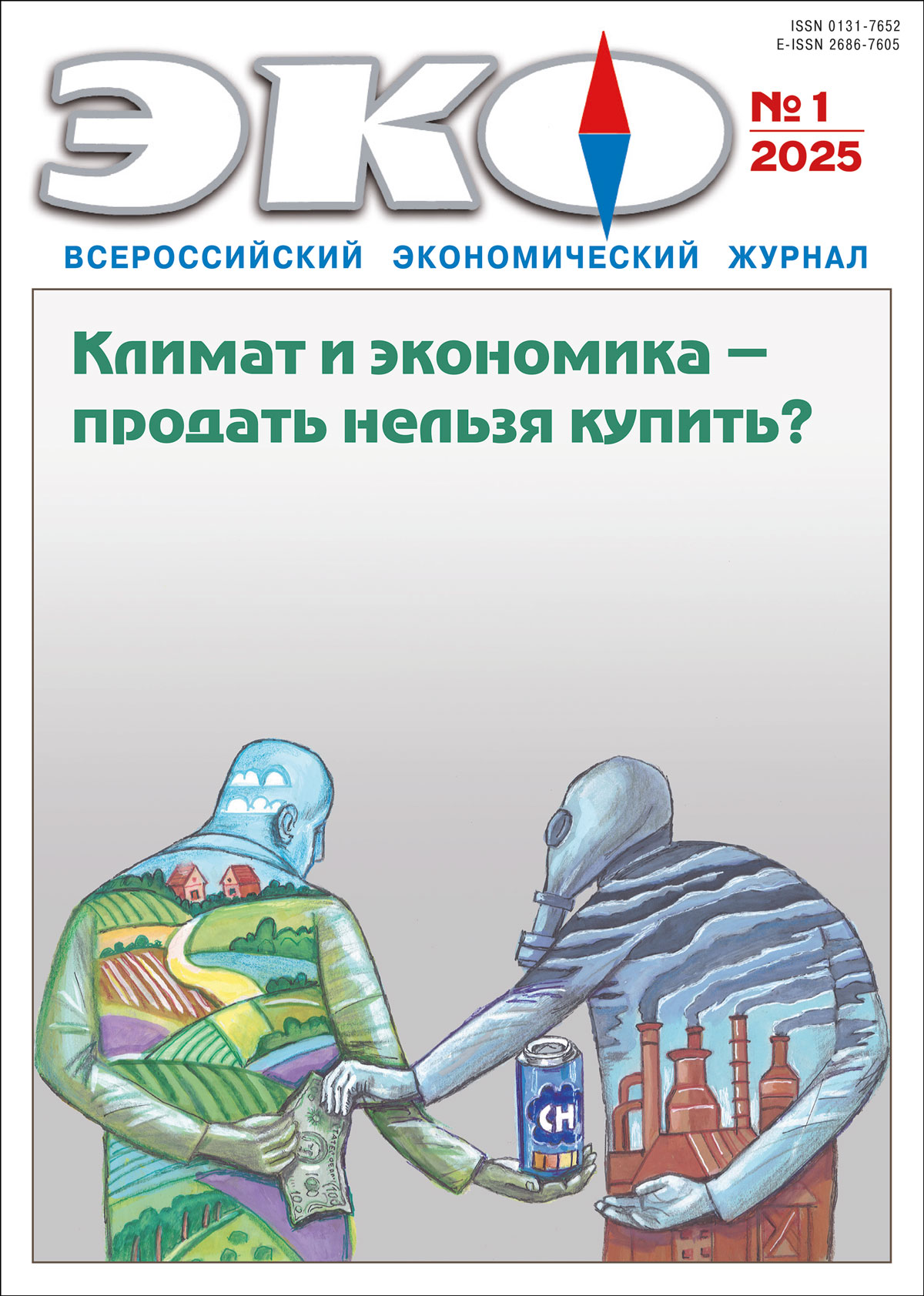

Cover story: Climate and economics – can’t sell / buy?

Published 2025-01-30

Keywords

- voluntary carbon market; carbon offsets; carbon credits; national emissions trading system (NETS), Paris Agreement; VLCCs; ITMO; China

How to Cite

1.

Maslennikov А. Voluntary Carbon Markets in China: Dynamics and Development Prospects. ECO [Internet]. 2025 Jan. 30 [cited 2026 Mar. 4];55(1):23-34. Available from: https://ecotrends.ru/index.php/eco/article/view/4813

Abstract

The paper examines the scale and objectives of participation of China and Chinese companies in international voluntary carbon markets, as well as the experience and prospects for the development of national and regional emissions trading systems. It shows the relationship between voluntary carbon markets and the national emissions trading system of the PRC. The author concludes that voluntary carbon markets in China are aimed at stimulating the development of renewable energy by attracting foreign and domestic financing, as well as mitigating the negative impact of the planned tightening of the national emissions trading system for real sector companies, thereby maintaining economic growth.References

- Жуков С.В., Резникова О.Б. Энергетический переход в США, Европе и Китае: новейшие тенденции // Проблемы прогнозирования. 2023. № 4 (199). С. 15–31.

- Cames, M., Ralph, O. H., Füssler, J., Lazarus, M., Lee, C. M., Erickson, P., & Spalding Fecher, R. (2016). How additional is the clean development mechanism? Öko-Institut e.V, Available at: https://climate.ec.europa.eu/system/files/2017–04/clean_dev_mechanism_en.pdf (accessed: 13.05.2024).

- Gütschow, J., Pflüger, M., Busch, D. (2023). The PRIMAP-hist national historical emissions time series v2.5.1 (1750–2022). Zenodo. DOI: 10.5281/zenodo.10705513

- Haya, B.K. et al. (2023). Quality assessment of REDD+ carbon credit projects. Berkeley Carbon Trading Project, Available at: https://gspp.berkeley.edu/assets/uploads/page/Quality-Assessment-of-REDD+-Carbon-Crediting-EXECUTIVE-SUMMARY.pdf (accessed: 13.05.2024).

- Haya, B.K., Abayo, A., So, I.S., Elias, M. (2023).Voluntary Registry Offsets Database v10. Berkeley Carbon Trading Project, University of California, Berkeley.

- Hove, A., Meidan, M., Andrews-Speed, P. (2021). Software versus hardware: how China’s institutional setting helps and hinders the clean energy transition. Oxford Institute for Energy Studies, Available at: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2021/12/Software-versus-hardware-how-Chinas-institutional-setting-helps-CE2.pdf (accessed: 13.05.2024).

- Piris-Cabezas, P., Lubowski, R.N., Leslie, G. (2023). Estimating the potential of international carbon markets to increase global climate ambition. World Development. Vol. 167. DOI: 10.1016/j.worlddev.2023.106257

- Qin, Y. (2022). China’s ETS: Performance, Impact, and Evolution. Oxford Energy Forum, 2022, No. 132, June. Available at: https://www.oxfordenergy.org/wpcms/wp-content/uploads/2022/06/OEF-132.pdf (accessed: 13.05.2024).

- Strand, J. (2023). Finance “Blending” and NDC achievement under the Paris agreement. Journal of Climate Finance. Vol. 5. DOI: 10.1016/j.jclimf.2023.100024